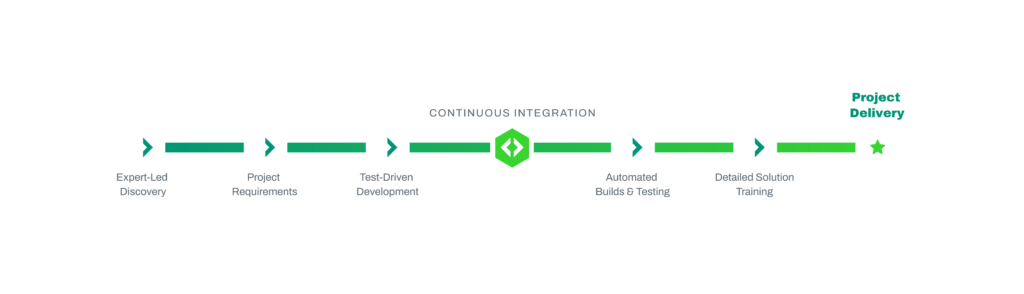

Client Journey

What you can expect when working with our capital markets experts for your software engineering project.

Connamara Agile

We’re deeply dedicated to the original principles and values of the Agile Manifesto while adapting the methodology for your enterprise needs.

See How Connamara Can Accelerate Your Digital Transformation

Discover the types of custom software solutions our capital markets experts can build to help your organization reach new heights.

Trading Technology

Reliable, easy-to-use trading platforms and tools designed around how today’s traders trade.

Exchange Technology

Custom-built solutions that launch new exchanges and marketplaces listing new asset classes straight to market.

RegTech and Compliance

Expert-developed custom RegTech and Compliance software to achieve regulatory demands.

Data Management

Our experts have experience managing diverse databases and data sets. We ensure your information is accurate, secure, and available at all times.

Systems Integration

Seamlessly connect technologies. We have unmatched experience with multiple platform APIs, protocols, messaging systems, and more.

Optimization, Automation, and Containerization

Our experienced team helps you leverage Agile development practices to improve your organization’s efficiency.